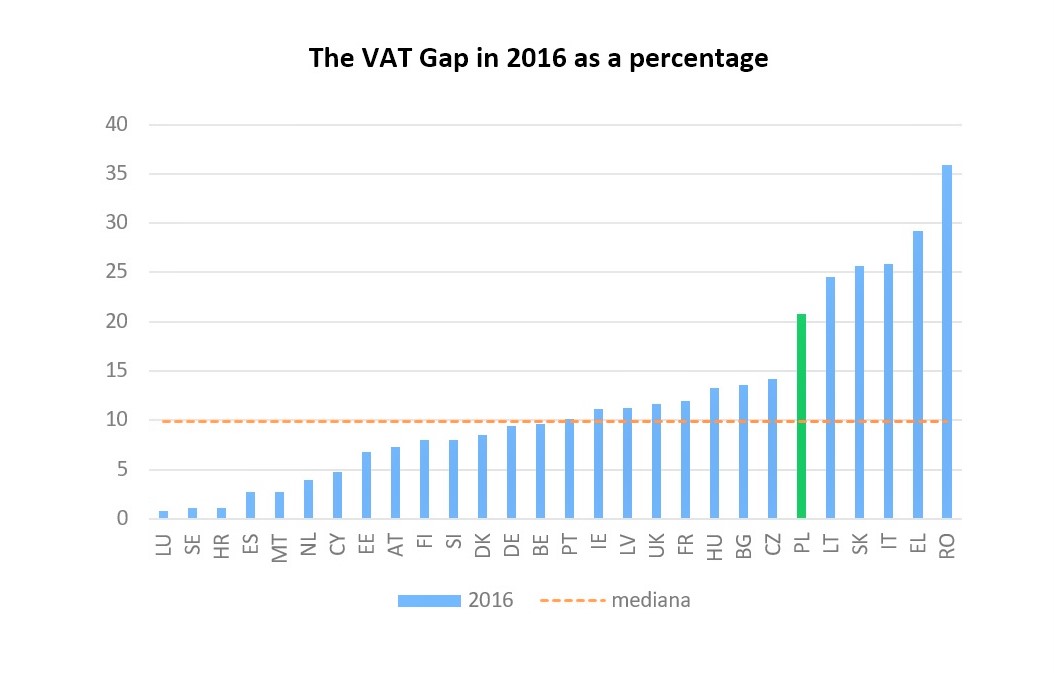

EUR 147.1 billion in VAT revenues was lost in 2016 in the EU - CASE - Center for Social and Economic Research

Alternative method to measure the VAT gap in the EU: Stochastic tax frontier model approach | PLOS ONE

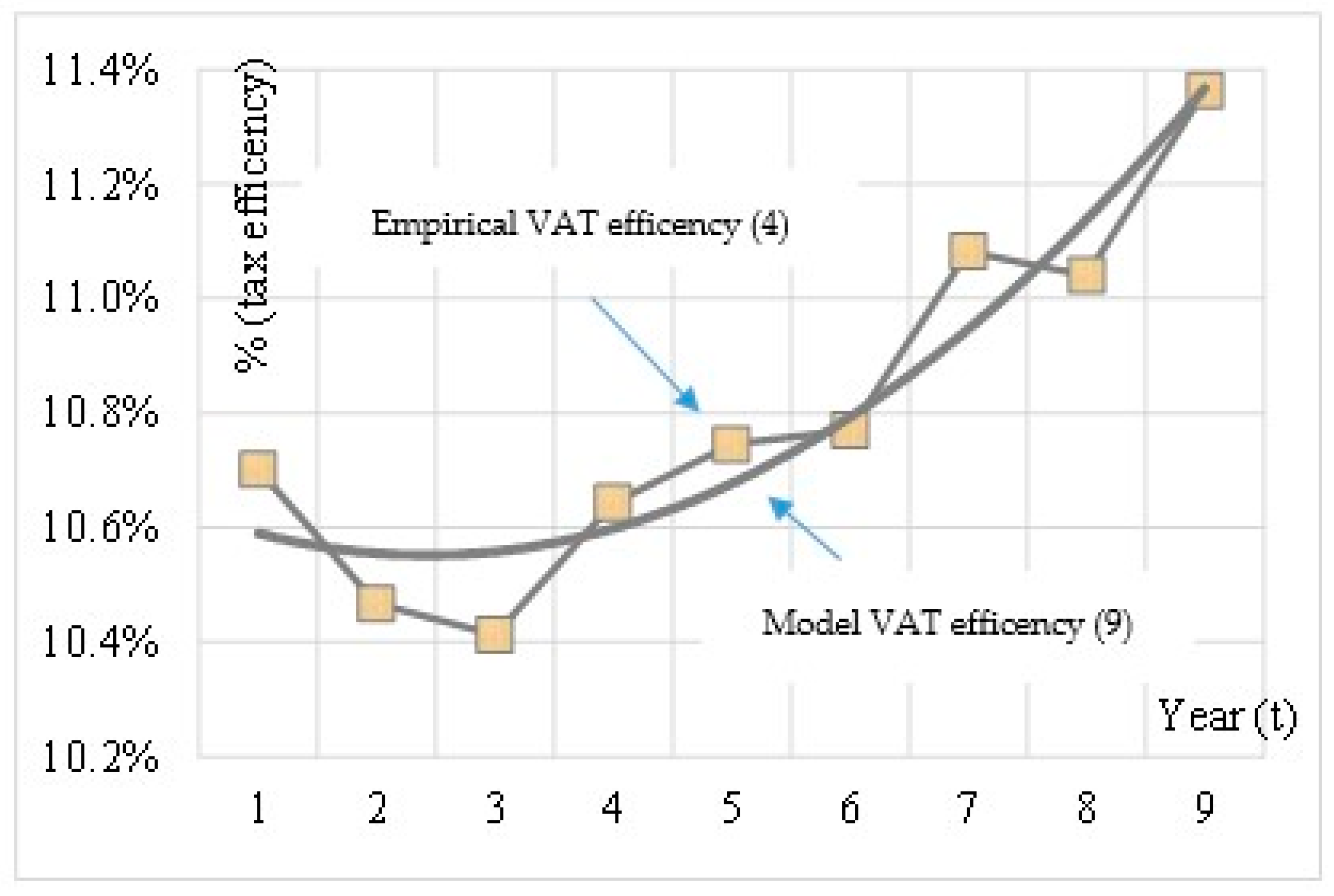

Sustainability | Free Full-Text | VAT Efficiency—A Discussion on the VAT System in the European Union

Sustainability | Free Full-Text | VAT Efficiency—A Discussion on the VAT System in the European Union