Sustainability | Free Full-Text | VAT Efficiency—A Discussion on the VAT System in the European Union

Value-added-tax rate increases: A comparative study using difference-in- difference with an ARIMA modeling approach | Humanities and Social Sciences Communications

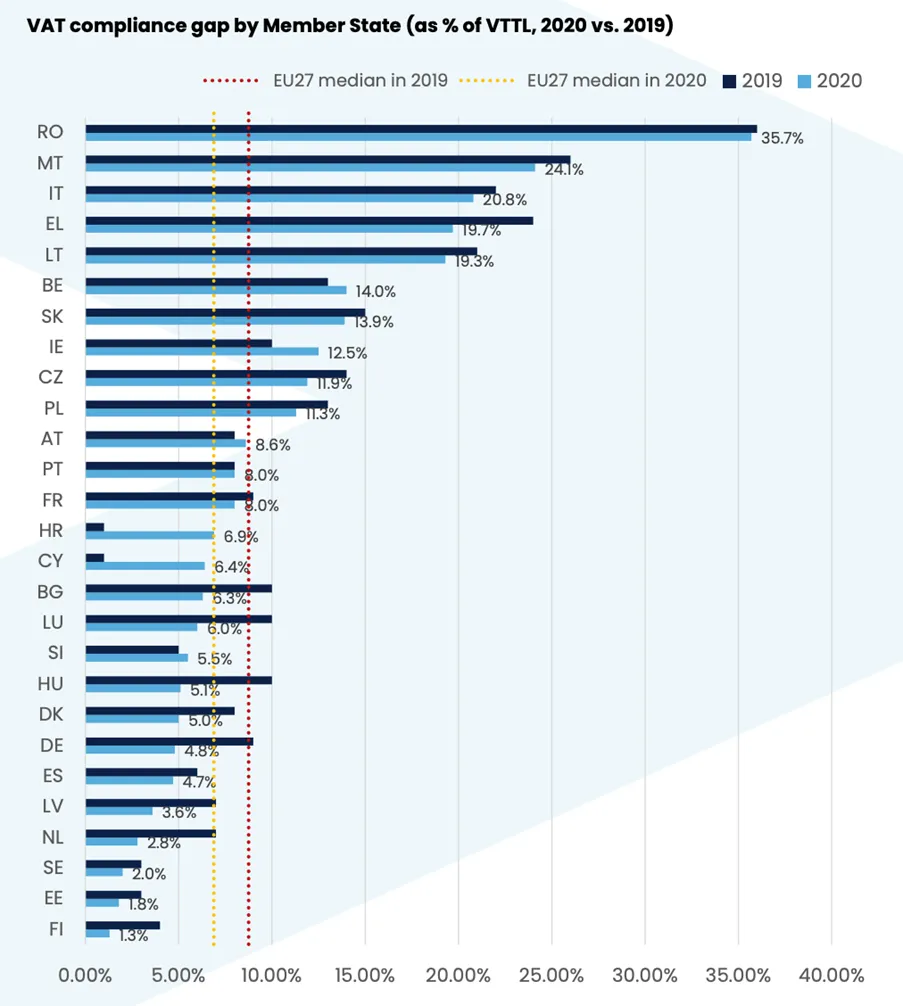

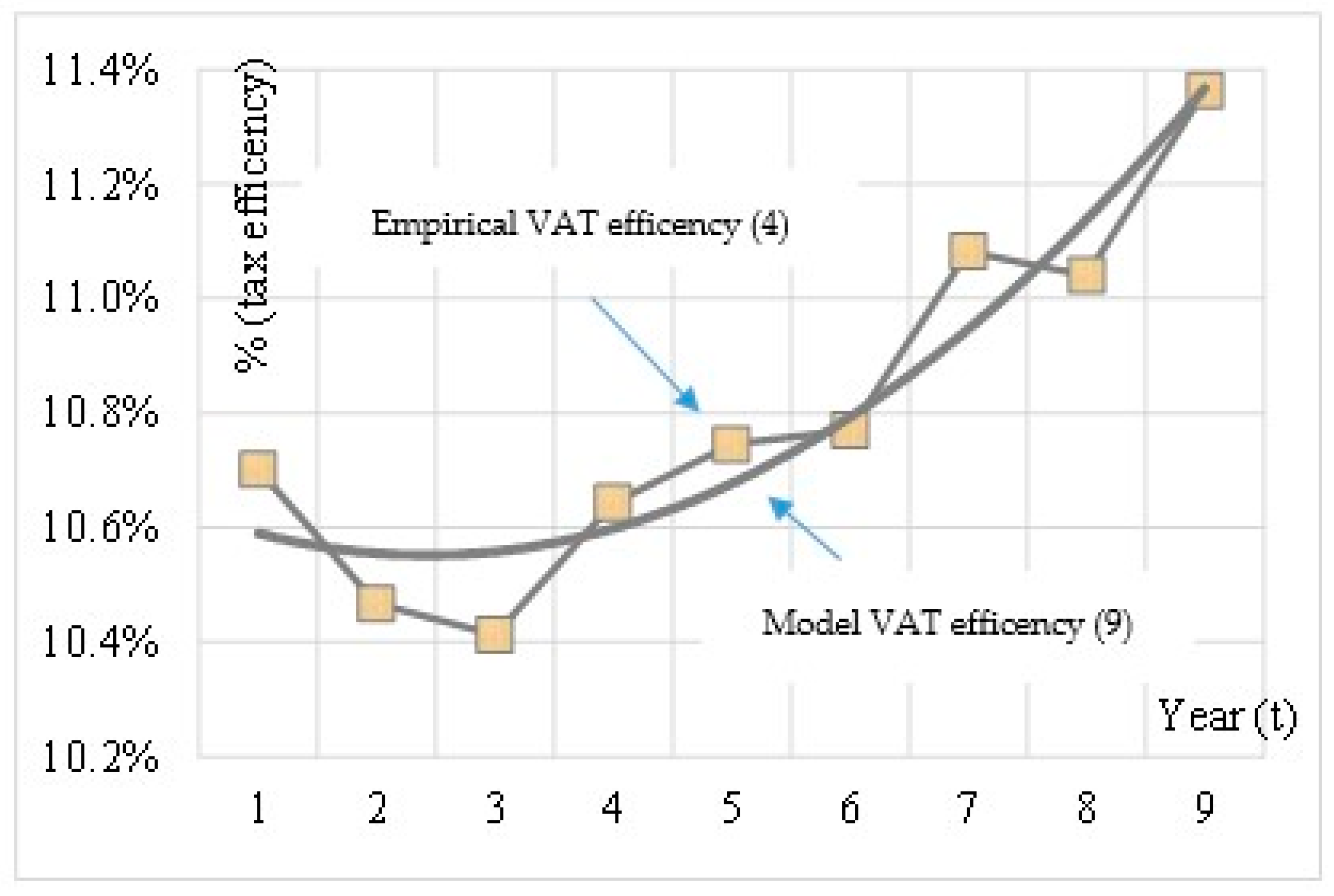

Alternative method to measure the VAT gap in the EU: Stochastic tax frontier model approach | PLOS ONE

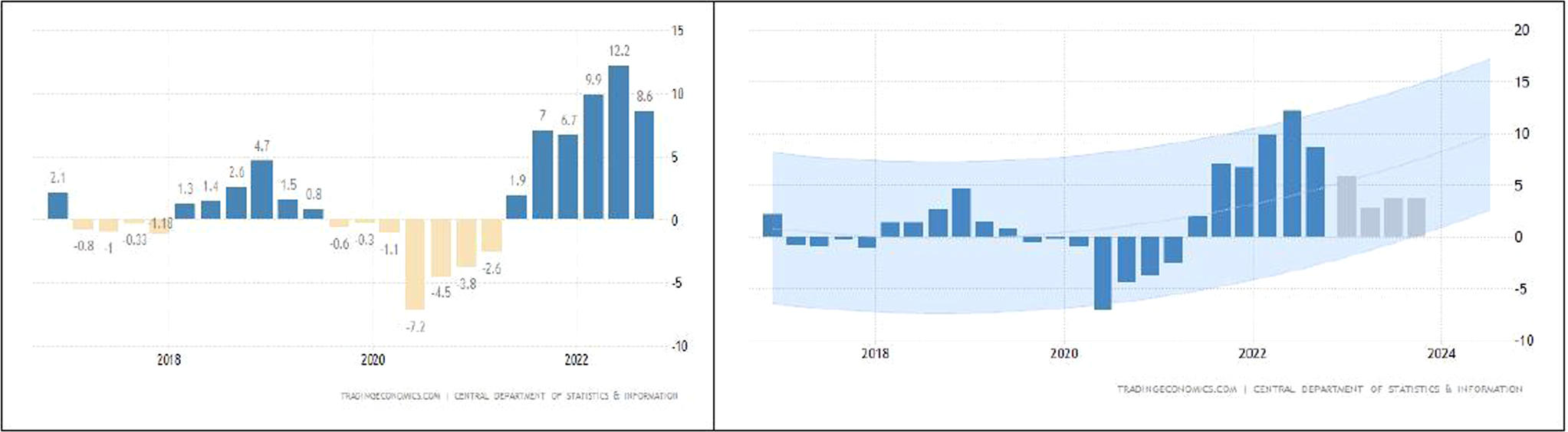

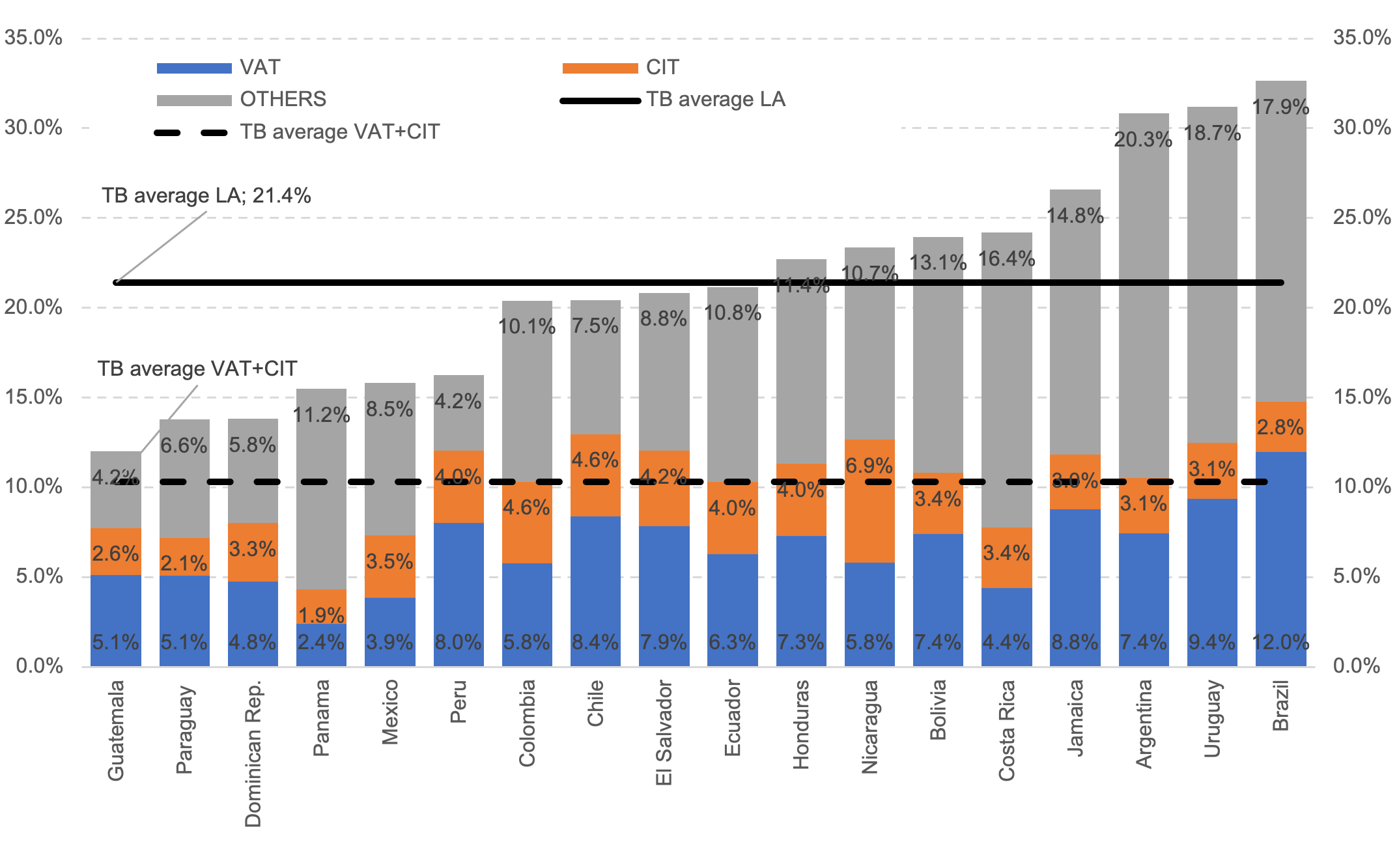

Revenue Efficiency of Value Added Tax and Corporate Income Tax | Inter-American Center of Tax Administrations